Portal:Economics

Portal maintenance status: (December 2018)

|

Introduction

Economics (/ɛkəˈnɒmɪks,

Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes basic elements in the economy, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the entire economy (meaning aggregated production, consumption, savings, and investment) and issues affecting it, including unemployment of resources (labour, capital, and land), inflation, economic growth, and the public policies that address these issues (monetary, fiscal, and other policies). See glossary of economics.

Selected general articles

- In economics, effective demand (ED) in a market is the demand for a product or service which occurs when purchasers are constrained in a different market. It contrasts with notional demand, which is the demand that occurs when purchasers are not constrained in any other market. In the aggregated market for goods in general, demand, notional or effective, is referred to as aggregate demand. The concept of effective supply parallels the concept of effective demand. The concept of effective demand or supply becomes relevant when markets do not continuously maintain equilibrium prices. Read more...

- Econometrics is the application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference". An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships". The first known use of the term "econometrics" (in cognate form) was by Polish economist Paweł Ciompa in 1910. Jan Tinbergen is considered by many to be one of the founding fathers of econometrics. Ragnar Frisch is credited with coining the term in the sense in which it is used today.

A basic tool for econometrics is the multiple linear regression model. Econometric theory uses statistical theory and mathematical statistics to evaluate and develop econometric methods. Econometricians try to find estimators that have desirable statistical properties including unbiasedness, efficiency, and consistency. Applied econometrics uses theoretical econometrics and real-world data for assessing economic theories, developing econometric models, analysing economic history, and forecasting. Read more... - Economic geography has been defined by the geographers as the study of human's economic activities under varying sets of conditions which is associated with production, location, distribution, consumption, exchange of resources, and spatial organization of economic activities across the world. It represents a traditional subfield of the discipline of geography. However, many economists have also approached the field in ways more typical of the discipline of economics.

Economic geography has taken a variety of approaches to many different subject matters, including the location of industries, economies of agglomeration (also known as "linkages"), transportation, international trade, development, real estate, gentrification, ethnic economies, gendered economies, core-periphery theory, the economics of urban form, the relationship between the environment and the economy (tying into a long history of geographers studying culture-environment interaction), and globalization. Read more... - In economics, a demand shock is a sudden event that increases or decreases demand for goods or services temporarily.

A positive demand shock increases aggregate demand (AD) and a negative demand shock decreases aggregate demand. Prices of goods and services are affected in both cases. When demand for goods or services increases, its price (or price levels) increases because of a shift in the demand curve to the right. When demand decreases, its price decreases because of a shift in the demand curve to the left. Demand shocks can originate from changes in things such as tax rates, money supply, and government spending. For example, taxpayers owe the government less money after a tax cut, thereby freeing up more money available for personal spending. When the taxpayers use the money to purchase goods and services, their prices go up. Read more... - Computational economics is a research discipline at the interface of computer science, economics, and management science. This subject encompasses computational modeling of economic systems, whether agent-based, general-equilibrium, macroeconomic, or rational-expectations, computational econometrics and statistics, computational finance, computational tools for the design

of automated internet markets, programming tools specifically designed for computational economics, and pedagogical tools for the teaching of computational economics. Some of these areas are unique to computational economics, while others extend traditional areas of economics by solving problems that are difficult to study without the use of computers and associated numerical methods.

Computational economics uses computer-based economic modeling for the solution of analytically and statistically formulated economic problems. A research program, to that end, is agent-based computational economics (ACE), the computational study of economic processes, including whole economies, as dynamic systems of interacting agents. As such, it is an economic adaptation of the complex adaptive systems paradigm. Here the "agent" refers to "computational objects modeled as interacting according to rules," not real people. Agents can represent social, biological, and/or physical entities. The theoretical assumption of mathematical optimization by agents in equilibrium is replaced by the less restrictive postulate of agents with bounded rationality adapting to market forces, including game-theoretical contexts. Starting from initial conditions determined by the modeler, an ACE model develops forward through time driven solely by agent interactions. The ultimate scientific objective of the method is "to ... test theoretical findings against real-world data in ways that permit empirically supported theories to cumulate over time, with each researcher’s work building appropriately on the work that has gone before." Read more... - Mainstream economic theory relies upon a priori quantitative economic models, which employ a variety of concepts. Theory typically proceeds with an assumption of ceteris paribus, which means holding constant explanatory variables other than the one under consideration. When creating theories, the objective is to find ones which are at least as simple in information requirements, more precise in predictions, and more fruitful in generating additional research than prior theories. While neoclassical economic theory constitutes both the dominant or orthodox theoretical as well as methodological framework, economic theory can also take the form of other schools of thought such as in heterodox economic theories.

In microeconomics, principal concepts include supply and demand, marginalism, rational choice theory, opportunity cost, budget constraints, utility, and the theory of the firm. Early macroeconomic models focused on modelling the relationships between aggregate variables, but as the relationships appeared to change over time macroeconomists, including new Keynesians, reformulated their models in microfoundations. Read more... - Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. By convention, these applied methods are beyond simple geometry, such as differential and integral calculus, difference and differential equations, matrix algebra, mathematical programming, and other computational methods. Proponents of this approach claim that it allows the formulation of theoretical relationships with rigor, generality, and simplicity.

Mathematics allows economists to form meaningful, testable propositions about wide-ranging and complex subjects which could less easily be expressed informally. Further, the language of mathematics allows economists to make specific, positive claims about controversial or contentious subjects that would be impossible without mathematics. Much of economic theory is currently presented in terms of mathematical economic models, a set of stylized and simplified mathematical relationships asserted to clarify assumptions and implications. Read more... - Monetary economics is the branch of economics that studies the different competing theories of money. It provides a framework for analyzing money and considers its functions, such as medium of exchange, store of value and unit of account. It considers how money, for example fiat currency, can gain acceptance purely because of its convenience as a public good. It examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

The discipline has historically prefigured, and remains integrally linked to, macroeconomics. Modern analysis has attempted to provide microfoundations for the demand for money and to distinguish valid nominal and real monetary relationships for micro or macro uses, including their influence on the aggregate demand for output. Its methods include deriving and testing the implications of money as a substitute for other assets and as based on explicit frictions. Read more... - Short-run equilibrium of the firm under monopolistic competition. The firm maximizes its profits and produces a quantity where the firm's marginal revenue (MR) is equal to its marginal cost (MC). The firm is able to collect a price based on the average revenue (AR) curve. The difference between the firm's average revenue and average cost, multiplied by the quantity sold (Qs), gives the total profit.

Monopolistic competition is a type of imperfect competition such that many producers sell products that are differentiated from one another (e.g. by branding or quality) and hence are not perfect substitutes. In monopolistic competition, a firm takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other firms. In the presence of coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the firm maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereal, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on the subject, Theory of Monopolistic Competition (1933). Joan Robinson published a book The Economics of Imperfect Competition with a comparable theme of distinguishing perfect from imperfect competition.

Monopolistically competitive markets have the following characteristics: Read more...  Adjacent advertisements in an 1885 newspaper for the makers of two competing ore concentrators (machines that separate out valuable ores from undesired minerals). The lower ad touts that their price is lower, and that their machine's quality and efficiency was demonstrated to be higher, both of which are general means of economic competition.

Adjacent advertisements in an 1885 newspaper for the makers of two competing ore concentrators (machines that separate out valuable ores from undesired minerals). The lower ad touts that their price is lower, and that their machine's quality and efficiency was demonstrated to be higher, both of which are general means of economic competition.

In economics, competition is a condition where different economic firms seek to obtain a share of a limited good by varying the elements of the marketing mix: price, product, promotion and place. In classical economic thought, competition causes commercial firms to develop new products, services and technologies, which would give consumers greater selection and better products. The greater selection typically causes lower prices for the products, compared to what the price would be if there was no competition (monopoly) or little competition (oligopoly).

Early economic research focused on the difference between price- and non-price-based competition, while later economic theory has focused on the many-seller limit of general equilibrium. Read more...- Jacob Marschak (23 July 1898 – 27 July 1977) was a Ukrainian-American economist, known as "the Father of Econometrics". Read more...

The IS–LM model, or Hicks–Hansen model, is a macroeconomic tool that shows the relationship between interest rates (ordinate) and assets market (also known as real output in goods and services market plus money market, as abscissa). The intersection of the "investment–saving" (IS) and "liquidity preference–money supply" (LM) curves models "general equilibrium" where supposed simultaneous equilibria occur in both interest and assets markets. Yet two equivalent interpretations are possible: first, the IS–LM model explains changes in national income when price level is fixed short-run; second, the IS–LM model shows why an aggregate demand curve can shift.

Hence, this tool is sometimes used not only to analyse economic fluctuations but also to suggest potential levels for appropriate stabilisation policies.

The model was developed by John Hicks in 1937, and later extended by Alvin Hansen, as a mathematical representation of Keynesian macroeconomic theory. Between the 1940s and mid-1970s, it was the leading framework of macroeconomic analysis. While it has been largely absent from macroeconomic research ever since, it is still a backbone conceptual introductory tool in many macroeconomics textbooks. Read more...- Monetary policy is the process by which the monetary authority of a country, typically the central bank or currency board, controls either the cost of very short-term borrowing or the monetary base, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.

Further goals of a monetary policy are usually to contribute to the stability of gross domestic product, to achieve and maintain low unemployment, and to maintain predictable exchange rates with other currencies. Read more...

The World Bank (French: Banque mondiale) is an international financial institution that provides loans to countries of the world for capital projects. It comprises two institutions: the International Bank for Reconstruction and Development (IBRD), and the International Development Association (IDA). The World Bank is a component of the World Bank Group.

The World Bank's most recent stated goal is the reduction of poverty. As of November 2018, the largest recipients of world bank loans were India ($859 million in 2018) and China ($370 million in 2018), through loans from IBRD. Read more...- New Keynesian economics is a school of contemporary macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

Two main assumptions define the New Keynesian approach to macroeconomics. Like the New Classical approach, New Keynesian macroeconomic analysis usually assumes that households and firms have rational expectations. However, the two schools differ in that New Keynesian analysis usually assumes a variety of market failures. In particular, New Keynesians assume that there is imperfect competition in price and wage setting to help explain why prices and wages can become "sticky", which means they do not adjust instantaneously to changes in economic conditions. Read more... - The general price level is a hypothetical daily measure of overall prices for some set of goods and services (the consumer basket), in an economy or monetary union during a given interval (generally one day), normalized relative to some base set. Typically, the general price level is approximated with a daily price index, normally the Daily CPI. The general price level can change more than once per day during hyperinflation. Read more...

- New institutional economics (NIE) is an economic perspective that attempts to extend economics by focusing on the social and legal norms and rules (which are institutions) that underlie economic activity and with analysis beyond earlier institutional economics and neoclassical economics. It can be seen as a broadening step to include aspects excluded in neoclassical economics. It rediscovers aspects of classical political economy. Read more...

- Welfare economics is a branch of economics that uses microeconomic techniques to evaluate well-being (welfare) at the aggregate (economy-wide) level. A typical methodology begins with the derivation (or assumption) of a social welfare function, which can then be used to rank economically feasible allocations of resources in terms of the social welfare they entail. Such functions typically include measures of economic efficiency and equity, though more recent attempts to quantify social welfare have included a broader range of measures including economic freedom (as in the capability approach).

The field of welfare economics is associated with two fundamental theorems. The first states that given certain assumptions, competitive markets produce (Pareto) efficient outcomes; it captures the logic of Adam Smith's invisible hand. The second states that given further restrictions, any Pareto efficient outcome can be supported as a competitive market equilibrium. Thus a social planner could use a social welfare function to pick the most equitable efficient outcome, then use lump sum transfers followed by competitive trade to bring it about. Because of welfare economics' close ties to social choice theory, Arrow's impossibility theorem is sometimes listed as a third fundamental theorem. Read more... - Dynamic stochastic general equilibrium modeling (abbreviated as DSGE, or DGE, or sometimes SDGE) is a method in macroeconomics that attempts to explain economic phenomena, such as economic growth and business cycles, and the effects of economic policy, through econometric models based on applied general equilibrium theory and microeconomic principles. Read more...

- In economics, general equilibrium theory attempts to explain the behavior of supply, demand, and prices in a whole economy with several or many interacting markets, by seeking to prove that the interaction of demand and supply will result in an overall general equilibrium. General equilibrium theory contrasts to the theory of partial equilibrium, which only analyzes single markets.

General equilibrium theory both studies economies using the model of equilibrium pricing and seeks to determine in which circumstances the assumptions of general equilibrium will hold. The theory dates to the 1870s, particularly the work of French economist Léon Walras in his pioneering 1874 work Elements of Pure Economics. Read more...

The World Trade Organization (WTO) is an intergovernmental organization that is concerned with the regulation of international trade between nations. The WTO officially commenced on 1 January 1995 under the Marrakesh Agreement, signed by 124 nations on 15 April 1994, replacing the General Agreement on Tariffs and Trade (GATT), which commenced in 1948. It is the largest international economic organization in the world.

The WTO deals with regulation of trade in goods, services and intellectual property between participating countries by providing a framework for negotiating trade agreements and a dispute resolution process aimed at enforcing participants' adherence to WTO agreements, which are signed by representatives of member governments and ratified by their parliaments. The WTO prohibits discrimination between trading partners, but provides exceptions for environmental protection, national security, and other important goals. Trade-related disputes are resolved by independent judges at the WTO through a dispute resolution process. Read more...

Malthusianism is the idea that population growth is potentially exponential while the growth of the food supply is linear. It derives from the political and economic thought of the Reverend Thomas Robert Malthus, as laid out in his 1798 writings, An Essay on the Principle of Population. Malthus believed there were two types of "checks" that in all times and places kept population growth in line with the growth of the food supply: "preventive checks", such as moral restraints (abstinence, delayed marriage until finances become balanced), and restricting marriage against persons suffering poverty or perceived as defective, and "positive checks", which lead to premature death such as disease, starvation and war, resulting in what is called a Malthusian catastrophe. The catastrophe would return population to a lower, more "sustainable", level. Malthusianism has been linked to a variety of political and social movements, but almost always refers to advocates of population control.

Neo-Malthusianism is the advocacy of population control programs to ensure resources for current and future populations. In Britain the term 'Malthusian' can also refer more specifically to arguments made in favour of preventive birth control, hence organizations such as the Malthusian League. Neo-Malthusians differ from Malthus's theories mainly in their enthusiasm for contraception. Malthus, a devout Christian, believed that "self-control" (abstinence) was preferable to artificial birth control. In some editions of his essay, Malthus did allow that abstinence was unlikely to be effective on a wide scale, thus advocating the use of artificial means of birth control as a solution to population "pressure". Modern "neo-Malthusians" are generally more concerned than Malthus was with environmental degradation and catastrophic famine than with poverty. Read more...- In economics, non-convexity refers to violations of the convexity assumptions of elementary economics. Basic economics textbooks concentrate on consumers with convex preferences (that do not prefer extremes to in-between values) and convex budget sets and on producers with convex production sets; for convex models, the predicted economic behavior is well understood. When convexity assumptions are violated, then many of the good properties of competitive markets need not hold: Thus, non-convexity is associated with market failures, where supply and demand differ or where market equilibria can be inefficient. Non-convex economies are studied with nonsmooth analysis, which is a generalization of convex analysis. Read more...

Tjalling Charles Koopmans (August 28, 1910 – February 26, 1985) was a Dutch American mathematician and economist. He was the joint winner with Leonid Kantorovich of the 1975 Nobel Memorial Prize in Economic Sciences for his work on the theory of the optimum allocation of resources. Koopmans showed that on the basis of certain efficiency criteria, it is possible to make important deductions concerning optimum price systems. Read more... Dorothea Lange's Migrant Mother depicts destitute pea pickers in California, centering on Florence Owens Thompson, age 32, a mother of seven children, in Nipomo, California, March 1936.

Dorothea Lange's Migrant Mother depicts destitute pea pickers in California, centering on Florence Owens Thompson, age 32, a mother of seven children, in Nipomo, California, March 1936.

The Great Depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States. The timing of the Great Depression varied across nations; in most countries it started in 1929 and lasted until the late-1930s. It was the longest, deepest, and most widespread depression of the 20th century. In the 21st century, the Great Depression is commonly used as an example of how intensely the world's economy can decline.

The Great Depression started in the United States after a major fall in stock prices that began around September 4, 1929, and became worldwide news with the stock market crash of October 29, 1929 (known as Black Tuesday). Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries the negative effects of the Great Depression lasted until the beginning of World War II. Read more...- In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1 (directly spendable holdings), or for money in the broader sense of M2 or M3.

Money in the sense of M1 is dominated as a store of value (even a temporary one) by interest-bearing assets. However, M1 is necessary to carry out transactions; in other words, it provides liquidity. This creates a trade-off between the liquidity advantage of holding money for near-future expenditure and the interest advantage of temporarily holding other assets. The demand for M1 is a result of this trade-off regarding the form in which a person's funds to be spent should be held. In macroeconomics motivations for holding one's wealth in the form of M1 can roughly be divided into the transaction motive and the precautionary motive. The demand for those parts of the broader money concept M2 that bear a non-trivial interest rate is based on the asset demand. These can be further subdivided into more microeconomically founded motivations for holding money. Read more...  The competitive price system according to Paul Samuelson

The competitive price system according to Paul Samuelson

In ordinary usage, a price is the quantity of payment or compensation given by one party to another in return for one unit of goods or services.

In modern economies, prices are generally expressed in units of some form of currency. (For commodities, they are expressed as currency per unit weight of the commodity, e.g. euros per kilogram or Rands per KG.) Although prices could be quoted as quantities of other goods or services, this sort of barter exchange is rarely seen. Prices are sometimes quoted in terms of vouchers such as trading stamps and air miles. In some circumstances, cigarettes have been used as currency, for example in prisons, in times of hyperinflation, and in some places during World War II. In a black market economy, barter is also relatively common. Read more...

Adam Smith FRSA (16 June [O.S. 5 June] 1723 – 17 July 1790) was a Scottish economist, philosopher and author as well as a moral philosopher, a pioneer of political economy and a key figure during the Scottish Enlightenment. Smith wrote two classic works, The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776). The latter, often abbreviated as The Wealth of Nations, is considered his magnum opus and the first modern work of economics.

Smith studied social philosophy at the University of Glasgow and at Balliol College, Oxford, where he was one of the first students to benefit from scholarships set up by fellow Scot John Snell. After graduating, he delivered a successful series of public lectures at Edinburgh, leading him to collaborate with David Hume during the Scottish Enlightenment. Smith obtained a professorship at Glasgow, teaching moral philosophy and during this time, wrote and published The Theory of Moral Sentiments. In his later life, he took a tutoring position that allowed him to travel throughout Europe, where he met other intellectual leaders of his day. Read more... The stock market crash of 1929 marked the start of the Great Depression, the most widespread in modern history, with effects felt until the start of World War II

The stock market crash of 1929 marked the start of the Great Depression, the most widespread in modern history, with effects felt until the start of World War II

In economics, a depression is a sustained, long-term downturn in economic activity in one or more economies. It is a more severe economic downturn than a recession, which is a slowdown in economic activity over the course of a normal business cycle.

A depression is an unusual and extreme form of recession. Depressions are characterized by their length, by abnormally large increases in unemployment, falls in the availability of credit (often due to some form of banking or financial crisis), shrinking output as buyers dry up and suppliers cut back on production and investment, large number of bankruptcies including sovereign debt defaults, significantly reduced amounts of trade and commerce (especially international trade), as well as highly volatile relative currency value fluctuations (often due to currency devaluations). Price deflation, financial crises and bank failures are also common elements of a depression that do not normally occur during a recession. Read more...- Capital flight, in economics, occurs when assets or money rapidly flow out of a country, due to an event of economic consequence. Such events could be an increase in taxes on capital or capital holders or the government of the country defaulting on its debt that disturbs investors and causes them to lower their valuation of the assets in that country, or otherwise to lose confidence in its economic strength.

This leads to a disappearance of wealth, and is usually accompanied by a sharp drop in the exchange rate of the affected country—depreciation in a variable exchange rate regime, or a forced devaluation in a fixed exchange rate regime. Read more...

The Organisation for Economic Co-operation and Development (OECD; French: Organisation de coopération et de développement économiques, OCDE) is an intergovernmental economic organisation with 36 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum of countries describing themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seeking answers to common problems, identify good practices and coordinate domestic and international policies of its members. Most OECD members are high-income economies with a very high Human Development Index (HDI) and are regarded as developed countries. As of 2017, the OECD member states collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP (Int$54.2 trillion) at purchasing power parity. OECD is an official United Nations observer.

In 1948, the OECD originated as the Organisation for European Economic Co-operation (OEEC), led by Robert Marjolin of France, to help administer the Marshall Plan (which was rejected by the Soviet Union and its satellite states). This would be achieved by allocating United States financial aid and implementing economic programs for the reconstruction of Europe after World War II. (Similar reconstruction aid was sent to the war-torn Republic of China and post-war Korea, but not under the name "Marshall Plan".) Read more... Knut Wicksell, Swedish economist. Important source of inspiration for John Maynard Keynes and the Stockholm School.

Knut Wicksell, Swedish economist. Important source of inspiration for John Maynard Keynes and the Stockholm School.

The Stockholm School (Swedish: Stockholmsskolan), is a school of economic thought. It refers to a loosely organized group of Swedish economists that worked together, in Stockholm, Sweden primarily in the 1930s.

The Stockholm School had—like John Maynard Keynes—come to the same conclusions in macroeconomics and the theories of demand and supply. Like Keynes, they were inspired by the works of Knut Wicksell, a Swedish economist active in the early years of the twentieth century. Read more...

Gary Stanley Becker (/ˈbɛkər/; December 2, 1930 – May 3, 2014) was an American economist and empiricist. He was a professor of economics and sociology at the University of Chicago. Described as "the most important social scientist in the past 50 years" by The New York Times, Becker was awarded the Nobel Memorial Prize in Economic Sciences in 1992 and received the United States Presidential Medal of Freedom in 2007. A 2011 survey of economics professors named Becker their favorite living economist over the age of 60, followed by Ken Arrow and Robert Solow.

Becker was one of the first economists to branch into what were traditionally considered topics that belonged to sociology, including racial discrimination, crime, family organization, and drug addiction (see rational addiction). He was known for arguing that many different types of human behavior can be seen as rational and utility maximizing. His approach included altruistic behavior of human behavior by defining individuals' utility appropriately. He was also among the foremost exponents of the study of human capital. Becker was also credited with the "rotten kid theorem." Read more...- In economics, market failure is a situation in which the allocation of goods and services by a free market is not efficient, often leading to a net social welfare loss. Market failures can be viewed as scenarios where individuals' pursuit of pure self-interest leads to results that are not efficient – that can be improved upon from the societal point of view. The first known use of the term by economists was in 1958, but the concept has been traced back to the Victorian philosopher Henry Sidgwick.

Market failures are often associated with time-inconsistent preferences, information asymmetries, non-competitive markets, principal–agent problems, or externalities.

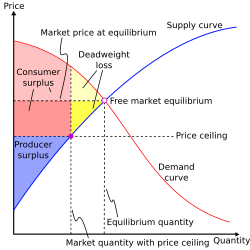

Public goods are both non-rival and non-excludable (i.e., public goods are not only non-excludable) thus existence of a market failure is often the reason that self-regulatory organizations, governments or supra-national institutions intervene in a particular market. Economists, especially microeconomists, are often concerned with the causes of market failure and possible means of correction. Such analysis plays an important role in many types of public policy decisions and studies. However, government policy interventions, such as taxes, subsidies, bailouts, wage and price controls, and regulations, may also lead to an inefficient allocation of resources, sometimes called government failure. Read more...  Deadweight loss created by a binding price ceiling. The producer surplus always decreases, but the consumer surplus may or may not increase; however, the decrease in producer surplus must be greater than the increase, if any, in consumer surplus.

Deadweight loss created by a binding price ceiling. The producer surplus always decreases, but the consumer surplus may or may not increase; however, the decrease in producer surplus must be greater than the increase, if any, in consumer surplus.

A deadweight loss, also known as excess burden or allocative inefficiency, is a loss of economic efficiency that can occur when equilibrium for a good or a service is not achieved. That can be caused by monopoly pricing in the case of artificial scarcity, an externality, a tax or subsidy, or a binding price ceiling or price floor such as a minimum wage. Read more...- In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It specifies the amounts of goods and services that will be purchased at all possible price levels. This is the demand for the gross domestic product of a country. It is often called effective demand, though at other times this term is distinguished.

The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. It is downward sloping as a result of three distinct effects: Pigou's wealth effect, Keynes' interest rate effect and the Mundell–Fleming exchange-rate effect. The Pigou effect states that a higher price level implies lower real wealth and therefore lower consumption spending, giving a lower quantity of goods demanded in the aggregate. The Keynes effect states that a higher price level implies a lower real money supply and therefore higher interest rates resulting from financial market equilibrium, in turn resulting in lower investment spending on new physical capital and hence a lower quantity of goods being demanded in the aggregate. Read more... - In economics, stagflation, a portmanteau of stagnation and inflation, is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high. It raises a dilemma for economic policy, since actions designed to lower inflation may exacerbate unemployment, and vice versa. The term is generally attributed to Iain Macleod, a British Conservative Party politician who became Chancellor of the Exchequer in 1970; Macleod coined the phrase in a speech to Parliament in 1965.

John Maynard Keynes did not use the term, but some of his work refers to the conditions that most would recognise as stagflation. In the version of Keynesian macroeconomic theory that was dominant between the end of World War II and the late 1970s, inflation and recession were regarded as mutually exclusive, the relationship between the two being described by the Phillips curve. Stagflation is very costly and difficult to eradicate once it starts, both in social terms and in budget deficits. Read more... - Harold Hotelling (/ˈhoʊtəlɪŋ/; September 29, 1895 – December 26, 1973) was an American mathematical statistician and an influential economic theorist, known for Hotelling's law, Hotelling's lemma, and Hotelling's rule in economics, as well as Hotelling's T-squared distribution in statistics. He also developed and named the principal component analysis method widely used in statistics and computer science.

He was Associate Professor of Mathematics at Stanford University from 1927 until 1931, a member of the faculty of Columbia University from 1931 until 1946, and a Professor of Mathematical Statistics at the University of North Carolina at Chapel Hill from 1946 until his death. A street in Chapel Hill bears his name. In 1972 he received the North Carolina Award for contributions to science. Read more... - Law and economics or economic analysis of law is the application of economic theory (specifically microeconomic theory) to the analysis of law that began mostly with scholars from the Chicago school of economics. Economic concepts are used to explain the effects of laws, to assess which legal rules are economically efficient, and to predict which legal rules will be promulgated. Read more...

- A supply shock is an event that suddenly increases or decreases the supply of a commodity or service, or of commodities and services in general. This sudden change affects the equilibrium price of the good or service or the economy's general price level.

In the short run, an economy-wide negative supply shock will shift the aggregate supply curve leftward, decreasing the output and increasing the price level. For example, the imposition of an embargo on trade in oil would cause an adverse supply shock, since oil is a key factor of production for a wide variety of goods. A supply shock can cause stagflation due to a combination of rising prices and falling output. Read more... - The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the

desirability of their consumption as measured by their preferences subject to limitations on their expenditures, by maximizing utility subject to a consumer budget constraint.

Consumption is separated from production, logically, because two different economic agents are involved. In the first case consumption is by the primary individual; in the second case, a producer might make something that he would not consume himself. Therefore, different motivations and abilities are involved. The models that make up consumer theory are used to represent prospectively observable demand patterns for an individual buyer on the hypothesis of constrained optimization. Prominent variables used to explain the rate at which the good is purchased (demanded) are the price per unit of that good, prices of related goods, and wealth of the consumer. Read more... - In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but deflation increases it. This allows one to buy more goods and services than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive.

Economists generally believe that deflation is a problem in a modern economy because it increases the real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral. Read more... - Pareto efficiency or Pareto optimality is a state of allocation of resources from which it is impossible to reallocate so as to make any one individual or preference criterion better off without making at least one individual or preference criterion worse off. The concept is named after Vilfredo Pareto (1848–1923), Italian engineer and economist, who used the concept in his studies of economic efficiency and income distribution. The concept has been applied in academic fields such as economics, engineering, and the life sciences.

The Pareto frontier is the set of all Pareto efficient allocations, conventionally shown graphically. It also is variously known as the Pareto front or Pareto set. Read more...

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation (typically measured by amount of output produced), with cost per unit of output decreasing with increasing scale. (In economics, "scale" is synonymous with quantity.)

Economies of scale apply to a variety of organizational and business situations and at various levels, such as a business or manufacturing unit, plant or an entire enterprise. When average costs start falling as output increases, then economies of scale are occurring. If a firm's marginal cost of producing a good or service is beneath its average cost of producing that good or service, then the firm is experiencing economies of scale.

Some economies of scale, such as capital cost of manufacturing facilities and friction loss of transportation and industrial equipment, have a physical or engineering basis. Read more...

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index, usually the consumer price index, over time. The opposite of inflation is deflation (negative inflation rate).

Inflation affects economies in various positive and negative ways. The negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future. Positive effects include reducing unemployment due to nominal wage rigidity, allowing the central bank more leeway in carrying out monetary policy, encouraging loans and investment instead of money hoarding, and avoiding the inefficiencies associated with deflation. Read more...- Health economics is a branch of economics concerned with issues related to efficiency, effectiveness, value and behavior in the production and consumption of health and healthcare. In broad terms, health economists study the functioning of healthcare systems and health-affecting behaviors such as smoking.

A seminal 1963 article by Kenneth Arrow, often credited with giving rise to health economics as a discipline, drew conceptual distinctions between health and other goods.

Factors that distinguish health economics from other areas include extensive government intervention, intractable uncertainty in several dimensions, asymmetric information, barriers to entry, externalities and the presence of a third-party agent. In healthcare, the third-party agent is the physician, who makes purchasing decisions (e.g., whether to order a lab test, prescribe a medication, perform a surgery, etc.) while being insulated from the price of the product or service. Read more...

Robert Merton Solow, GCIH (/ˈsoʊloʊ/; born August 23, 1924), is an American economist, particularly known for his work on the theory of economic growth that culminated in the exogenous growth model named after him. He is currently Emeritus Institute Professor of Economics at the Massachusetts Institute of Technology, where he has been a professor since 1949. He was awarded the John Bates Clark Medal in 1961, the Nobel Memorial Prize in Economic Sciences in 1987, and the Presidential Medal of Freedom in 2014. Four of his PhD students, George Akerlof, Joseph Stiglitz, Peter Diamond and William Nordhaus later received Nobel Memorial Prizes in Economic Sciences in their own right. Read more...- An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited or borrowed.

It is defined as the proportion of an amount loaned which a lender charges as interest to the borrower, normally expressed as an annual percentage. It is the rate a bank or other lender charges to borrow its money, or the rate a bank pays its savers for keeping money in an account. Read more...

Did you know...

- ... that the book Midas Touch, co-authored by Donald Trump and Robert Kiyosaki, praises the economic benefits of immigration to the United States?

- ... that the Thai monk Luang Por Dattajivo writes about economics from a Buddhist perspective?

- ... that the announcement of the reopening of the Embassy of Poland in Manila coincided with Poland's decision to expand its economic involvement in Asia?

- ... that environmental activists might be opposed to economic globalization, but advocate environmental globalization?

- ... that at the time of its release in 2002, economic simulations like Sea Trader: Rise of Taipan were uncommon on handheld systems like the Game Boy Advance?

- ... that soybeans helped Argentine president Eduardo Duhalde resolve an economic crisis?

Need help?

Do you have a question about Economics that you can't find the answer to?

Consider asking it at the Wikipedia reference desk.

Get involved

For editor resources and to collaborate with other editors on improving Wikipedia's Economics-related articles, see WikiProject Economics.

Selected images

A map of world economies by size of GDP (nominal) in USD, World Bank, 2014.

The publication of Adam Smith's The Wealth of Nations in 1776 is considered to be the first formalisation of economic thought.

Electronic trading brings together buyers and sellers through an electronic trading platform and network to create virtual market places. Pictured: São Paulo Stock Exchange, Brazil.

John Maynard Keynes (right), was a key theorist in economics.

Environmental scientist sampling water

The percentage of the US population employed, 1995–2012.

An example production–possibility frontier with illustrative points marked.

A map showing the main trade routes for goods within late medieval Europe.

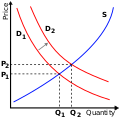

The supply and demand model describes how prices vary as a result of a balance between product availability and demand. The graph depicts an increase (that is, right-shift) in demand from D1 to D2 along with the consequent increase in price and quantity required to reach a new equilibrium point on the supply curve (S).

A basic illustration of economic/business cycles.

Pollution can be a simple example of market failure. If costs of production are not borne by producers but are by the environment, accident victims or others, then prices are distorted.

Economists study trade, production and consumption decisions, such as those that occur in a traditional marketplace.

A 1638 painting of a French seaport during the heyday of mercantilism.

The Marxist school of economic thought comes from the work of German economist Karl Marx.

In the news

- 2 February 2019 – Crisis in Venezuela, 2019 Venezuelan presidential crisis

- Hundreds of thousands of Venezuelan people take to the streets to protest socio-economic and political situation of the country and to demand a better economic situation. Large competing anti-Maduro and anti-Guaidó rallies are held in Caracas. (The Washington Post)

Subcategories

- Select [►] to view subcategories

Subtopics

Associated Wikimedia

The following Wikimedia Foundation sister projects provide more on this subject:

Wikibooks

Books

Commons

Media

Wikinews

News

Wikiquote

Quotations

Wikisource

Texts

Wikiversity

Learning resources

Wiktionary

Definitions

Wikidata

Database

- What are portals?

- List of portals

.svg/280px-Countries_by_Real_GDP_Growth_Rate_(2016).svg.png)

.svg/220px-World_Trade_Organization_(logo_and_wordmark).svg.png)

_in_2014.svg/120px-Countries_by_GDP_(Nominal)_in_2014.svg.png)

.svg/120px-Countries_by_Real_GDP_Growth_Rate_(2016).svg.png)

_Per_Capita_in_2015.svg/120px-Countries_by_GDP_(PPP)_Per_Capita_in_2015.svg.png)