Coefficient of determination

In statistics, the coefficient of determination, denoted R2 or r2 and pronounced "R squared", is the proportion of the variance in the dependent variable that is predictable from the independent variable(s).

It is a statistic used in the context of statistical models whose main purpose is either the prediction of future outcomes or the testing of hypotheses, on the basis of other related information. It provides a measure of how well observed outcomes are replicated by the model, based on the proportion of total variation of outcomes explained by the model.[1][2][3]

There are several definitions of R2 that are only sometimes equivalent. One class of such cases includes that of simple linear regression where r2 is used instead of R2. When an intercept is included, then r2 is simply the square of the sample correlation coefficient (i.e., r) between the observed outcomes and the observed predictor values.[4] If additional regressors are included, R2 is the square of the coefficient of multiple correlation. In both such cases, the coefficient of determination ranges from 0 to 1.

There are cases where the computational definition of R2 can yield negative values, depending on the definition used. This can arise when the predictions that are being compared to the corresponding outcomes have not been derived from a model-fitting procedure using those data. Even if a model-fitting procedure has been used, R2 may still be negative, for example when linear regression is conducted without including an intercept, or when a non-linear function is used to fit the data.[5] In cases where negative values arise, the mean of the data provides a better fit to the outcomes than do the fitted function values, according to this particular criterion.[6] Since the most general definition of the coefficient of determination is also known as the Nash–Sutcliffe model efficiency coefficient, this last notation is preferred in many fields, because denoting a goodness-of-fit indicator that can vary from -∞ to 1 (i.e., it can yield negative values) with a squared letter is confusing.

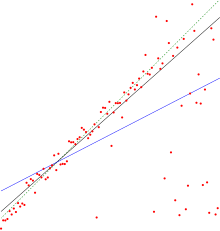

When evaluating the goodness-of-fit of simulated (Ypred) vs. measured (Yobs) values, it is not appropriate to base this on the R2 of the linear regression (i.e., Yobs= m·Ypred + b). The R2 quantifies the degree of any linear correlation between Yobs and Ypred, while for the goodness-of-fit evaluation only one specific linear correlation should be taken into consideration: Yobs = 1·Ypred + 0 (i.e., the 1:1 line).[7][8]

Contents

Definitions[edit]

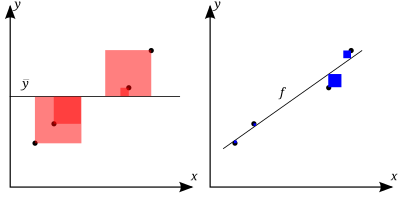

The better the linear regression (on the right) fits the data in comparison to the simple average (on the left graph), the closer the value of is to 1. The areas of the blue squares represent the squared residuals with respect to the linear regression. The areas of the red squares represent the squared residuals with respect to the average value.

A data set has n values marked y1,...,yn (collectively known as yi or as a vector y = [y1,...,yn]T), each associated with a predicted (or modeled) value f1,...,fn (known as fi, or sometimes ŷi, as a vector f).

Define the residuals as ei = yi − fi (forming a vector e).

If is the mean of the observed data:

then the variability of the data set can be measured using three sums of squares formulas:

- The total sum of squares (proportional to the variance of the data):

- The regression sum of squares, also called the explained sum of squares:

- The sum of squares of residuals, also called the residual sum of squares:

The most general definition of the coefficient of determination is

Relation to unexplained variance[edit]

In a general form, R2 can be seen to be related to the fraction of variance unexplained (FVU), since the second term compares the unexplained variance (variance of the model's errors) with the total variance (of the data):

As explained variance[edit]

Suppose R2 = 0.49. This implies that 49% of the variability of the dependent variable has been accounted for, and the remaining 51% of the variability is still unaccounted for. In some cases the total sum of squares equals the sum of the two other sums of squares defined above,

See Partitioning in the general OLS model for a derivation of this result for one case where the relation holds. When this relation does hold, the above definition of R2 is equivalent to

where n is the number of observations (cases) on the variables.

In this form R2 is expressed as the ratio of the explained variance (variance of the model's predictions, which is SSreg / n) to the total variance (sample variance of the dependent variable, which is SStot / n).

This partition of the sum of squares holds for instance when the model values ƒi have been obtained by linear regression. A milder sufficient condition reads as follows: The model has the form

where the qi are arbitrary values that may or may not depend on i or on other free parameters (the common choice qi = xi is just one special case), and the coefficient estimates and are obtained by minimizing the residual sum of squares.

This set of conditions is an important one and it has a number of implications for the properties of the fitted residuals and the modelled values. In particular, under these conditions:

As squared correlation coefficient[edit]

In linear least squares multiple regression with an estimated intercept term, R2 equals the square of the Pearson correlation coefficient between the observed and modeled (predicted) data values of the dependent variable.

In a linear least squares regression with an intercept term and a single explanator, this is also equal to the squared Pearson correlation coefficient of the dependent variable and explanatory variable

It should not be confused with the correlation between two coefficient estimates, defined as

where the covariance between two coefficient estimates, as well as their standard deviations, are obtained from the covariance matrix of the coefficient estimates.

Under more general modeling conditions, where the predicted values might be generated from a model different from linear least squares regression, an R2 value can be calculated as the square of the correlation coefficient between the original and modeled data values. In this case, the value is not directly a measure of how good the modeled values are, but rather a measure of how good a predictor might be constructed from the modeled values (by creating a revised predictor of the form α + βƒi).[citation needed] According to Everitt (p. 78),[9] this usage is specifically the definition of the term "coefficient of determination": the square of the correlation between two (general) variables.

Interpretation[edit]

R2 is a statistic that will give some information about the goodness of fit of a model. In regression, the R2 coefficient of determination is a statistical measure of how well the regression predictions approximate the real data points. An R2 of 1 indicates that the regression predictions perfectly fit the data.

Values of R2 outside the range 0 to 1 can occur when the model fits the data worse than a horizontal hyperplane. This would occur when the wrong model was chosen, or nonsensical constraints were applied by mistake. If equation 1 of Kvålseth[10] is used (this is the equation used most often), R2 can be less than zero. If equation 2 of Kvålseth is used, R2 can be greater than one.

In all instances where R2 is used, the predictors are calculated by ordinary least-squares regression: that is, by minimizing SSres. In this case R2 increases as we increase the number of variables in the model (R2 is monotone increasing with the number of variables included—i.e., it will never decrease). This illustrates a drawback to one possible use of R2, where one might keep adding variables (Kitchen sink regression) to increase the R2 value. For example, if one is trying to predict the sales of a model of car from the car's gas mileage, price, and engine power, one can include such irrelevant factors as the first letter of the model's name or the height of the lead engineer designing the car because the R2 will never decrease as variables are added and will probably experience an increase due to chance alone.

This leads to the alternative approach of looking at the adjusted R2. The explanation of this statistic is almost the same as R2 but it penalizes the statistic as extra variables are included in the model. For cases other than fitting by ordinary least squares, the R2 statistic can be calculated as above and may still be a useful measure. If fitting is by weighted least squares or generalized least squares, alternative versions of R2 can be calculated appropriate to those statistical frameworks, while the "raw" R2 may still be useful if it is more easily interpreted. Values for R2 can be calculated for any type of predictive model, which need not have a statistical basis.

In a non-simple linear model[edit]

Consider a linear model with more than a single explanatory variable, of the form

where, for the ith case, is the response variable, are p regressors, and is a mean zero error term. The quantities are unknown coefficients, whose values are estimated by least squares. The coefficient of determination R2 is a measure of the global fit of the model. Specifically, R2 is an element of [0, 1] and represents the proportion of variability in Yi that may be attributed to some linear combination of the regressors (explanatory variables) in X.[11]

R2 is often interpreted as the proportion of response variation "explained" by the regressors in the model. Thus, R2 = 1 indicates that the fitted model explains all variability in , while R2 = 0 indicates no 'linear' relationship (for straight line regression, this means that the straight line model is a constant line (slope = 0, intercept = ) between the response variable and regressors). An interior value such as R2 = 0.7 may be interpreted as follows: "Seventy percent of the variance in the response variable can be explained by the explanatory variables. The remaining thirty percent can be attributed to unknown, lurking variables or inherent variability."

A caution that applies to R2, as to other statistical descriptions of correlation and association is that "correlation does not imply causation." In other words, while correlations may sometimes provide valuable clues in uncovering causal relationships among variables, a non-zero estimated correlation between two variables is not, on its own, evidence that changing the value of one variable would result in changes in the values of other variables. For example, the practice of carrying matches (or a lighter) is correlated with incidence of lung cancer, but carrying matches does not cause cancer (in the standard sense of "cause").

In case of a single regressor, fitted by least squares, R2 is the square of the Pearson product-moment correlation coefficient relating the regressor and the response variable. More generally, R2 is the square of the correlation between the constructed predictor and the response variable. With more than one regressor, the R2 can be referred to as the coefficient of multiple determination.

Inflation of R2[edit]

In least squares regression, R2 is weakly increasing with increases in the number of regressors in the model. Because increases in the number of regressors increase the value of R2, R2 alone cannot be used as a meaningful comparison of models with very different numbers of independent variables. For a meaningful comparison between two models, an F-test can be performed on the residual sum of squares, similar to the F-tests in Granger causality, though this is not always appropriate. As a reminder of this, some authors denote R2 by Rq2, where q is the number of columns in X (the number of explanators including the constant).

To demonstrate this property, first recall that the objective of least squares linear regression is

where Xi is a row vector of values of explanatory variables for case i and b is a column vector of coefficients of the respective elements of Xi.

The optimal value of the objective is weakly smaller as more explanatory variables are added and hence additional columns of (the explanatory data matrix whose ith row is Xi) are added, by the fact that less constrained minimization leads to an optimal cost which is weakly smaller than more constrained minimization does. Given the previous conclusion and noting that depends only on y, the non-decreasing property of R2 follows directly from the definition above.

The intuitive reason that using an additional explanatory variable cannot lower the R2 is this: Minimizing is equivalent to maximizing R2. When the extra variable is included, the data always have the option of giving it an estimated coefficient of zero, leaving the predicted values and the R2 unchanged. The only way that the optimization problem will give a non-zero coefficient is if doing so improves the R2.

Caveats[edit]

R2 does not indicate whether:

- the independent variables are a cause of the changes in the dependent variable;

- omitted-variable bias exists;

- the correct regression was used;

- the most appropriate set of independent variables has been chosen;

- there is collinearity present in the data on the explanatory variables;

- the model might be improved by using transformed versions of the existing set of independent variables;

- there are enough data points to make a solid conclusion.

Extensions[edit]

Adjusted R2[edit]

The use of an adjusted R2 (one common notation is , pronounced "R bar squared"; another is ) is an attempt to take account of the phenomenon of the R2 automatically and spuriously increasing when extra explanatory variables are added to the model. It is a modification due to Henri Theil of R2 that adjusts for the number of explanatory terms in a model relative to the number of data points.[12] The adjusted R2 can be negative, and its value will always be less than or equal to that of R2. Unlike R2, the adjusted R2 increases only when the increase in R2 (due to the inclusion of a new explanatory variable) is more than one would expect to see by chance. If a set of explanatory variables with a predetermined hierarchy of importance are introduced into a regression one at a time, with the adjusted R2 computed each time, the level at which adjusted R2 reaches a maximum, and decreases afterward, would be the regression with the ideal combination of having the best fit without excess/unnecessary terms. The adjusted R2 is defined as

where p is the total number of explanatory variables in the model (not including the constant term), and n is the sample size.

Adjusted R2 can also be written as

where dft is the degrees of freedom n– 1 of the estimate of the population variance of the dependent variable, and dfe is the degrees of freedom n – p – 1 of the estimate of the underlying population error variance.

The principle behind the adjusted R2 statistic can be seen by rewriting the ordinary R2 as

where and are the sample variances of the estimated residuals and the dependent variable respectively, which can be seen as biased estimates of the population variances of the errors and of the dependent variable. These estimates are replaced by statistically unbiased versions: and .

Adjusted R2 can be interpreted as an unbiased (or less biased) estimator of the population R2, whereas the observed sample R2 is a positively biased estimate of the population value.[13] Adjusted R2 is more appropriate when evaluating model fit (the variance in the dependent variable accounted for by the independent variables) and in comparing alternative models in the feature selection stage of model building.[13]

Coefficient of partial determination[edit]

The coefficient of partial determination can be defined as the proportion of variation that cannot be explained in a reduced model, but can be explained by the predictors specified in a full(er) model.[14][15][16] This coefficient is used to provide insight into whether or not one or more additional predictors may be useful in a more fully specified regression model.

The calculation for the partial R2 is relatively straightforward after estimating two models and generating the ANOVA tables for them. The calculation for the partial R2 is

which is analogous to the usual coefficient of determination:

Generalizing and decomposing [17][edit]

As explained above, model selection heuristics such as the Adjusted criterion and the F-test examine whether the total sufficiently increases to determine whether a new regressor should be added to the model. If a regressor is added to the model that is highly correlated with other regressors which have already been included, then the total will hardly increase even if the new regressor is of relevance. As a result, the above-mentioned heuristics will ignore relevant regressors when cross-correlations are high.

Alternatively, one can decompose a generalized version of to quantify the relevance of deviating from a hypothesis.[17] As Hoornweg (2018) shows, several shrinkage estimators - such as Bayesian linear regression, ridge regression, and the (adaptive) lasso - make use of this decomposition of when they gradually shrink parameters from the unrestricted OLS solutions towards the hypothesized values. Let us first define the linear regression model as

It is assumed that the matrix is standardized with Z-scores and that the column vector is centered to have a mean of zero. Let the column vector refer to the hypothesized regression parameters and let the column vector denote the estimated parameters. We can then define

An of 75% means that the in-sample accuracy improves by 75% if the data-optimized solutions are used instead of the hypothesized values. In the special case that is a vector of zeros, we obtain the traditional again.

The individual effect on of deviating from a hypothesis can be computed with ('R-outer'). This times matrix is given by

where . The diagonal elements of exactly add up to . If regressors are uncorrelated and is a vector of zeros, then the diagonal element of simply corresponds to the value between and . When regressors and are correlated, might increase at the cost of a decrease in . As a result, the diagonal elements of may be smaller than 0 and, in more exceptional cases, larger than 1. To deal with such uncertainties, several shrinkage estimators implicitly take a weighted average of the diagonal elements of to quantify the relevance of deviating from a hypothesized value.[17] Click on the lasso for an example.

in logistic regression[edit]

In the case of logistic regression, usually fit by maximum likelihood, there are several choices of pseudo-R2.

One is the generalized R2 originally proposed by Cox & Snell,[18] and independently by Magee:[19]

where is the likelihood of the model with only the intercept, is the likelihood of the estimated model (i.e., the model with a given set of parameter estimates) and n is the sample size. It is easily rewritten to:

where D is the test statistic of the likelihood ratio test.

Nagelkerke[20] noted that it had the following properties:

- It is consistent with the classical coefficient of determination when both can be computed;

- Its value is maximised by the maximum likelihood estimation of a model;

- It is asymptotically independent of the sample size;

- The interpretation is the proportion of the variation explained by the model;

- The values are between 0 and 1, with 0 denoting that model does not explain any variation and 1 denoting that it perfectly explains the observed variation;

- It does not have any unit.

However, in the case of a logistic model, where cannot be greater than 1, R2 is between 0 and : thus, Nagelkerke suggested the possibility to define a scaled R2 as R²/R2max.[21]

Comparison with norm of residuals[edit]

Occasionally, the norm of residuals is used for indicating goodness of fit. This term is calculated as the square-root of the sum of squared residuals:

Both R2 and the norm of residuals have their relative merits. For least squares analysis R2 varies between 0 and 1, with larger numbers indicating better fits and 1 representing a perfect fit. The norm of residuals varies from 0 to infinity with smaller numbers indicating better fits and zero indicating a perfect fit. One advantage and disadvantage of R2 is the term acts to normalize the value. If the yi values are all multiplied by a constant, the norm of residuals will also change by that constant but R2 will stay the same. As a basic example, for the linear least squares fit to the set of data:

R2 = 0.998, and norm of residuals = 0.302. If all values of y are multiplied by 1000 (for example, in an SI prefix change), then R2 remains the same, but norm of residuals = 302.

Other single parameter indicators of fit include the standard deviation of the residuals, or the RMSE of the residuals. These would have values of 0.151 and 0.174 respectively for the above example given that the fit was linear with an unforced intercept.[22]

History[edit]

The creation of the coefficient of determination has been attributed to the geneticist Sewall Wright and was first published in 1921.[23]

See also[edit]

- Fraction of variance unexplained

- Goodness of fit

- Nash–Sutcliffe model efficiency coefficient (hydrological applications)

- Pearson product-moment correlation coefficient

- Proportional reduction in loss

- Regression model validation

- Root mean square deviation

- t-test of

Notes[edit]

- ^ Steel, R. G. D.; Torrie, J. H. (1960). Principles and Procedures of Statistics with Special Reference to the Biological Sciences. McGraw Hill.

- ^ Glantz, Stanton A.; Slinker, B. K. (1990). Primer of Applied Regression and Analysis of Variance. McGraw-Hill. ISBN 978-0-07-023407-9.

- ^ Draper, N. R.; Smith, H. (1998). Applied Regression Analysis. Wiley-Interscience. ISBN 978-0-471-17082-2.

- ^ Devore, Jay L. (2011). Probability and Statistics for Engineering and the Sciences (8th ed.). Boston, MA: Cengage Learning. pp. 508–510. ISBN 978-0-538-73352-6.

- ^ Colin Cameron, A.; Windmeijer, Frank A.G. (1997). "An R-squared measure of goodness of fit for some common nonlinear regression models". Journal of Econometrics. 77 (2): 1790–2. doi:10.1016/S0304-4076(96)01818-0.

- ^ Imdadullah, Muhammad. "Coefficient of Determination". itfeature.com.

- ^ Legates, D.R.; McCabe, G.J. (1999). "Evaluating the use of "goodness-of-fit" measures in hydrologic and hydroclimatic model validation". Water Resour. Res. 35 (1): 233–241. doi:10.1029/1998WR900018.

- ^ Ritter, A.; Muñoz-Carpena, R. (2013). "Performance evaluation of hydrological models: statistical significance for reducing subjectivity in goodness-of-fit assessments". Journal of Hydrology. 480 (1): 33–45. doi:10.1016/j.jhydrol.2012.12.004.

- ^ Everitt, B. S. (2002). Cambridge Dictionary of Statistics (2nd ed.). CUP. ISBN 978-0-521-81099-9.

- ^ Kvalseth, Tarald O. (1985). "Cautionary Note about R2". The American Statistician. 39 (4): 279–285. doi:10.2307/2683704. JSTOR 2683704.

- ^ Computing Adjusted R2 for Polynomial Regressions

- ^ Theil, Henri (1961). Economic Forecasts and Policy. Holland, Amsterdam: North.[page needed]

- ^ a b Shieh, Gwowen (2008-04-01). "Improved shrinkage estimation of squared multiple correlation coefficient and squared cross-validity coefficient". Organizational Research Methods. 11 (2): 387–407. doi:10.1177/1094428106292901. ISSN 1094-4281.

- ^ Richard Anderson-Sprecher, "Model Comparisons and R2", The American Statistician, Volume 48, Issue 2, 1994, pp. 113–117.

- ^ (generalized to Maximum Likelihood) N. J. D. Nagelkerke, "A Note on a General Definition of the Coefficient of Determination", Biometrika, Vol. 78, No. 3. (Sep., 1991), pp. 691–692.

- ^ "R implementation of coefficient of partial determination"

- ^ a b c Hoornweg, Victor (2018). "Part II: On Keeping Parameters Fixed". Science: Under Submission. Hoornweg Press. ISBN 978-90-829188-0-9.

- ^ Cox, D. D.; Snell, E. J. (1989). The Analysis of Binary Data (2nd ed.). Chapman and Hall.

- ^ Magee, L. (1990). "R2 measures based on Wald and likelihood ratio joint significance tests". The American Statistician. 44. pp. 250–3. doi:10.1080/00031305.1990.10475731.

- ^ Nagelkerke, Nico J. D. (1992). Maximum Likelihood Estimation of Functional Relationships, Pays-Bas. Lecture Notes in Statistics. 69. ISBN 978-0-387-97721-8.

- ^ Nagelkerke, N. J. D. (1991). "A Note on a General Definition of the Coefficient of Determination". Biometrika. 78 (3): 691–2. doi:10.1093/biomet/78.3.691. JSTOR 2337038.

- ^ OriginLab webpage, http://www.originlab.com/doc/Origin-Help/LR-Algorithm. Retrieved February 9, 2016.

- ^ Wright, Sewell (January 1921). "Correlation and causation". Journal of Agricultural Research. 20: 557–585.

References[edit]

- Gujarati, Damodar N.; Porter, Dawn C. (2009). Basic Econometrics (Fifth ed.). New York: McGraw-Hill/Irwin. pp. 73–78. ISBN 978-0-07-337577-9.

- Kmenta, Jan (1986). Elements of Econometrics (Second ed.). New York: Macmillan. pp. 240–243. ISBN 978-0-02-365070-3.